Medicare Supplement (Medigap) Plan Guide

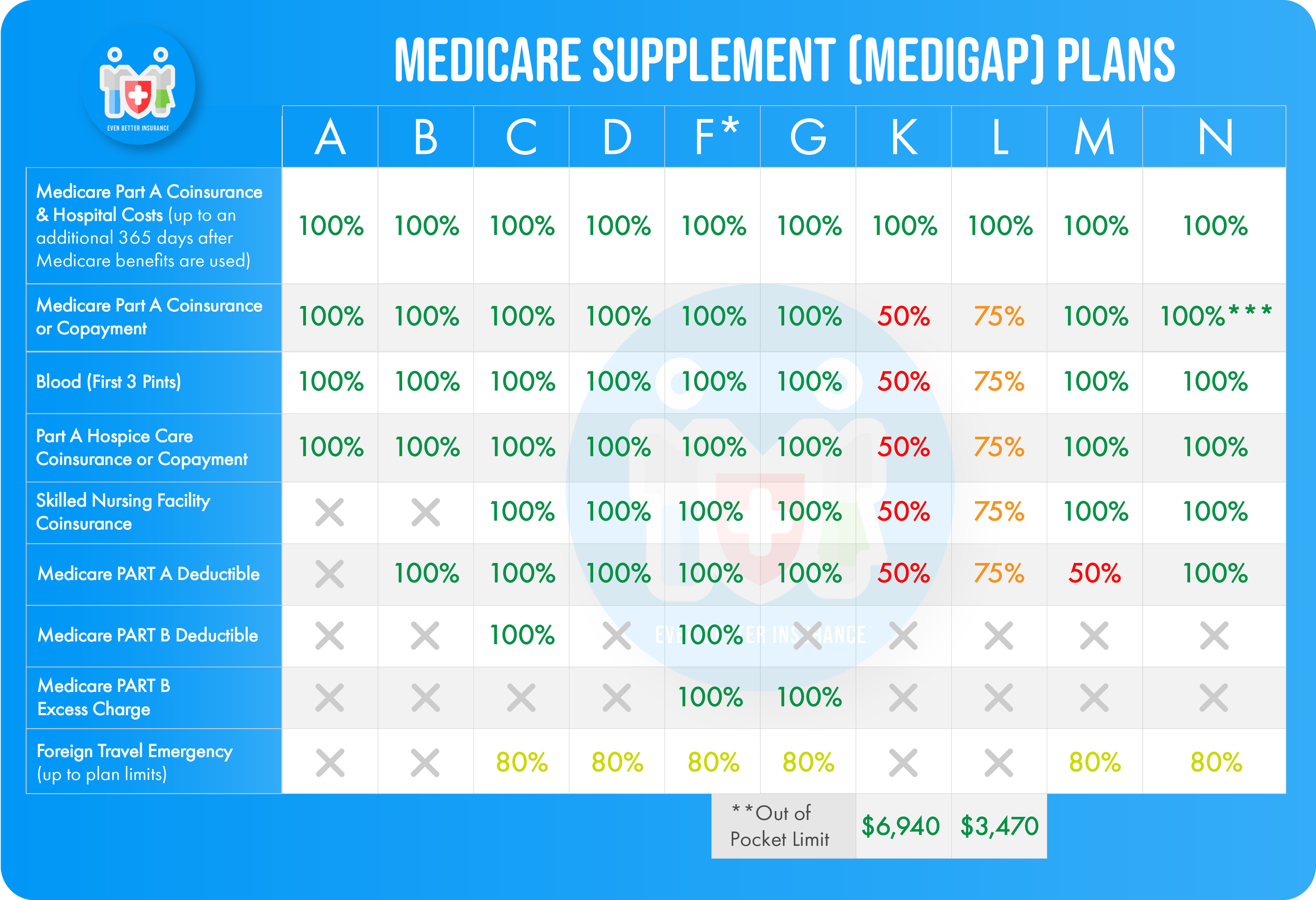

There are 10 standard Medicare Supplement (also known as Medigap) plans, all of which are identified by letters. The 10 plans are: Plan A, B, C, D, F, G, K, L, M, and N. Each of these plans is standardized by the federal government, meaning that Plan A (and all other plans) will cover the same basic benefits regardless of which company you purchase it through.

The main difference between companies selling these standardized Medigap plans is that companies may charge different premiums for the plan or may add benefits on top of the standardized basic benefits required by the federal government.

Here is a handy quick reference chart as well as an individual summary of each plan.

* Plan F also offers a high-deductible plan in some states. With this option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,700 in 2023 before your policy pays anything. (Plans C and F won’t be available to people who are newly eligible for Medicare on or after January 1, 2020. See previous page for more information.)

** For Plans K and L, after you meet your out-of-pocket yearly limit and your yearly Part B deductible ($226 in 2023), the Medigap plan pays 100% of covered services for the rest of the calendar year.

*** Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that don’t result in an inpatient admission.

Understanding the Medigap plan comparison chart:

Part A coinsurance and hospital costs - Every standard Medigap plan covers your Part A (hospital insurance) coinsurance.

Part B coinsurance - Original Medicare only covers 80% of your Part B costs and coinsurance. Your Medigap plan covers the remaining 20% of costs (at the amount listed on the chart) which can often be extremely expensive!

Blood (first 3 pints) - If you receive blood, you are responsible for paying for the first 3 pints out of pocket, then Medicare will pay for the 4th and up. Medigap plans help you cover the cost of those first 3 pints of blood.

Part A hospice care coinsurance or copayment - This benefit helps to cover the copays for drugs and coinsurance for inpatient respite care if you receive hospice care.

Skilled Nursing Facility coinsurance - This benefit helps cover the coinsurances you are normally responsible for on Medicare for days 21-100 of care at a Skilled Nursing Facility. Days 1-20 are no cost to you under Medicare.

Part A deductible - The 2023 Part A deductible is $1,600 per benefit period (a benefit period begins the first day you receive inpatient care and ends the day when you haven't received inpatient care for 60 days in a row). This means that you may be responsible for paying the Part A deductible several times in one year unless your Medigap plan covers it. This is an out-pocket cost that you have to pay first before your Medicare cost sharing will begin (copayment and coinsurances to lower your costs).

Part B deductible - The 2023 Part B deductible is $226 per year. Meaning that you only have to meet this deductible once in a year. Due to a recent change in the law, If you became eligible for Medicare after Jan 1. 2020, none of the Medigap plans are allowed to cover your Part B deductible. If you became eligible for Medicare before Jan 1. 2020, you are still able to receive Part B deductible coverage through a Medigap plan.

Part B excess charge - Not all providers accept Medicare. If you seek services or care from a provider who doesn’t accept Medicare, then that provider can choose to charge you up to 15% more than the normal Medicare allowable rate is for that procedure. You are responsible for paying this excess charge out of pocket unless your Medigap policy provides coverage for Part B excess charges.

Foreign travel exchange - This is essentially a worldwide emergency health insurance benefit. Because Medicare does not cover you outside of the United States, this may be a helpful benefit if you travel.

Out-of-Pocket Limit - This is the maximum amount that you will spend out of your own pocket for healthcare expenses, copayments, coinsurance and deductibles before the plan picks up the rest of all of your covered services for the remainder of the year. This is a great way to keep your healthcare spending low. Remember that monthly premiums usually do not count towards your Out-of-pocket limit.

Did you find a plan that interests you? Still have questions? Let our ‘Even Better’ Medicare plan experts answer your questions and help you select a plan!